Managing student loans after MBA graduation: Repayment options and advice

Let's explore repayment options and offer valuable advice to help you tackle your student debt with confidence.

Understanding Your Student Loans

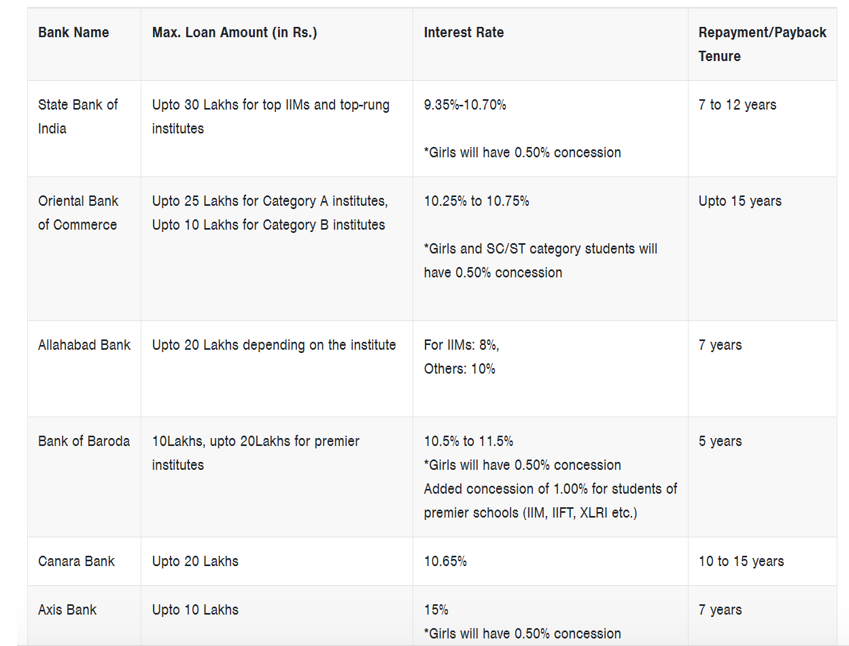

Before diving into repayment strategies, it's crucial to understand the types of student loans you may have acquired during your MBA journey. Whether federal or private, knowing the specifics of your loans—interest rates, repayment terms, and any grace periods—is the first step toward creating a solid repayment plan.

**Also Read: ** Navigating MBA vs PGDM How To Analyze the Mock Test?

Exploring Repayment Options:

- Income-Driven Repayment Plans: These plans, offered for federal student loans, adjust your monthly payments based on your income, making them more manageable, especially during the early stages of your career.

- Loan Consolidation: Consolidating your federal loans can streamline repayment by combining multiple loans into one, potentially lowering your monthly payment and simplifying the process.

- Refinancing Private Loans: If you have private loans, refinancing could be a smart move to secure a lower interest rate, potentially saving you thousands over the life of the loan. However, be mindful of any federal loan benefits you might lose by refinancing.

- Employer Student Loan Assistance Programs: Some employers offer student loan repayment assistance as part of their benefits package. Explore whether your employer offers such programs and take advantage of any opportunities to lighten your debt burden.

Smart Strategies for Loan Repayment:

- Create a Budget: Establishing a realistic budget that accounts for your monthly expenses and loan payments is essential for staying on track financially.

- Prioritize High-Interest Loans: If you have multiple loans, focus on paying off those with the highest interest rates first. This strategy can save you money in the long run.

- Explore Forgiveness Programs: Depending on your career path, you may qualify for loan forgiveness programs such as Public Service Loan Forgiveness (PSLF) or loan repayment assistance for professionals in specific fields.

- Stay Informed: Keep yourself updated on changes to student loan policies and explore any new repayment options that may benefit you.

Conclusion:

Managing student loans after MBA graduation may seem daunting, but with the right knowledge and strategies, you can navigate this financial challenge successfully. By understanding your loan options, exploring repayment plans, and implementing smart strategies, you'll be well-equipped to conquer your student debt and embark on a financially secure future as a business leader. Remember, you've already mastered business school—now, it's time to conquer your finances like a pro!